3 Proven Strategies to Pay Off Debt

We all want to pay off debt that is stressfully hanging over our head. Whether it be student loans, credit card debt, purchasing a car, or an unexpected medical bill, there are so many ways to accumulate debt. Whatever your motivation, you need to have a plan but first know where to start.

There are options. First, let’s talk over a few large debt repayment strategies, and after that, we’ll go over some practical ideas to make progress toward debt repayment.Strategies to Pay Off Debt

There are some helpful repayment strategies out there that can pay off debt. They all have pros and cons, so choose what works best for you and which one will help you to stay motivated in your debt repayment journey.

Strategy 1: Debt Snowball - Start Small, Go Big

When you pay off debt using the debt snowball method, you start with your smallest debt first and work up to the larger ones, paying minimum payments on your larger debts until the smallest one is paid off.

Pros: This is a great momentum-building strategy, because as you pay off each small debt, you have that much more money to add to the amount you’re putting toward your remaining debts. For example, if you have $200 dollars extra per month to pay off debt and you finish paying off credit card that had a monthly payment of $75, you now have $275 per month to put towards paying off your next largest debt, and so on.

Cons: Your smallest debt may not be your debt with the highest interest rate, so while you are paying off that debt, your higher interest debts will continue accruing interest, which means it may take you longer to pay off your debt.

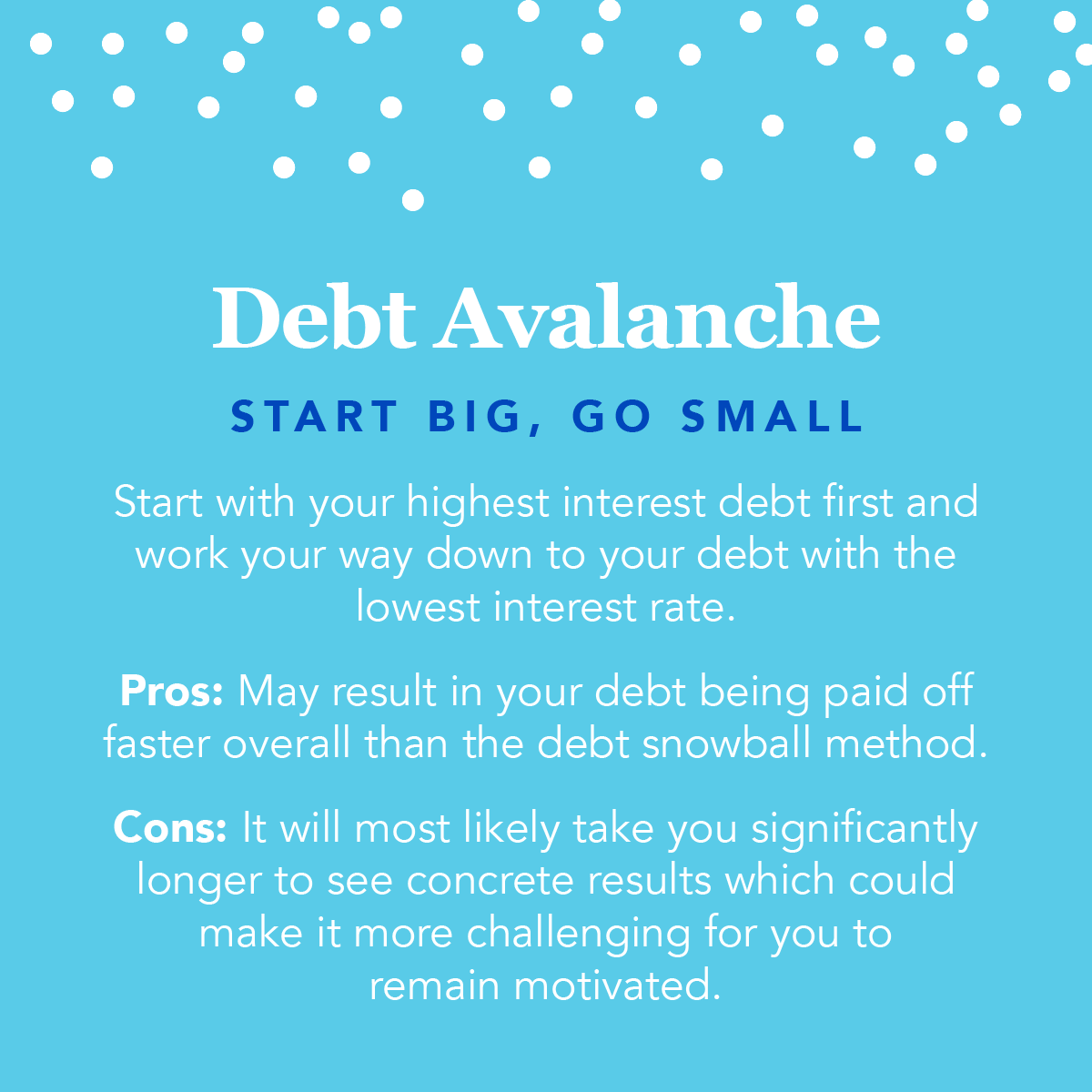

Strategy 2: Debt Avalanche - Start Big, Go Small

When you use the debt avalanche method to pay off debt, you start with your highest interest debt first and work your way down to your debt with the lowest interest rate. If most of your debt is credit card debt, since they generally all have high interest rates, this may not be the best strategy, but if you have debt with a variety of interest rates this could be a good choice.

Pros: This can save you money you would have spent paying off interest in the long run and may result in your debt being paid off faster overall than the debt snowball method.

Cons: It will most likely take you significantly longer to see concrete results if you tackle your largest/highest interest debt off first, which could make it more challenging for you to remain motivated in your debt repayment strategy. There is not as much quick progress to help you feel inspired to continue striving for your debt repayment goals.

Strategy 3: Debt Consolidation

Debt consolidation strategy is one in which you combine multiple smaller debts into one lump sum larger debt. There are a couple primary ways to consolidate debt. The first one is balance transfers and the second is personal loans. Debt consolidation is appealing because generally the consolidated loan has a lower interest rate, which makes the monthly payment lower and the payoff period faster.

Balance Transfers

A balance transfer is an option for people with decent credit scores, because it requires getting a credit card offer that carries with it a low interest rate: “This fits well with the avalanche method, since you can use a balance transfer to strategically reduce the interest rate on your highest-interest debt. That can buy you time to focus on the next-highest interest account, and reduce the total interest you pay.

Many balance transfer credit cards even offer a 0% APR for an introductory period, which allows you to pay off your balance without incurring extra interest charges” (Harkness, 2019). If you transfer $5,000 of debt from a high interest credit card to one with little to no interest, even with the balance transfer fee (generally a small percentage of your total transfer amount), you will most likely end up saving hundreds of dollars or more in interest. Just do some careful planning to make sure you can pay off all or most of the debt before the introductory interest rate ends.

Personal Loans

Another way to pay off debt is to consolidate smaller debts into one larger personal loan--generally through a bank.This is a simplifying strategy because it combines your (formerly) multiple payments per month into one lump sum payment per month. Personal loans usually have a set interest rate that is far lower than a credit card interest rate, and they also have a timeline for repayment, so you know exactly when you will be finished repaying the loan and getting out of debt.

Watch Out for Debt Forgiveness

There are many private companies who may offer to reduce your debt for a fee--they send you flyers in the mail promising to cut your debt in half, but if something sounds too good to be true, it usually is. While there may be a few bright spots in the world of debt forgiveness, the danger with debt forgiveness companies is that they won’t actually do what they promise. Their strategy is to charge you an upfront cost in exchange for negotiating with your creditors to reduce your debt. Unfortunately, they usually just keep your money and your debt remains your responsibility, as it already was.

Practical Ways to Make or Save Extra Cash

When you’re serious about paying off debt, the first thing you need to do is make a budget and stick with it. You may find it possible to add ways to earn additional income or things that you could go without in order to have more money free to put toward your debt.

Here are a few ideas:

- Get a second job -- even 1-2 shifts working a retail job or at a coffee shop can bring in a few hundred dollars more per month that you can use to pay off debt

- Live with roommates -- this can cut your cost of living nearly in half

- Do some freelancing -- use the skills you have to bring in some extra cash, whether that be writing, mowing lawns, cleaning, or photography

- Get rid of cable TV -- in the world of streaming, do you really need to spend $100+ per month on a cable subscription? Consider how much value you are really getting from having all these channels available to you.

- Sell your extra stuff -- do you have clothes you’ve barely worn, artwork that never made it up on the wall? Sell it online or on an app. Not only will you make some cash, you will free up some space in your closet!

- Cash windfall? Put it towards debt - If you get a bonus check, put it towards your debt.

Take Action

The ultimate way to pay off debt once and for all is by developing a healthy mindset and healthy habits about money. Take action towards paying off debt with these three simple steps: 1) Choose a Strategy; 2) Make or Save Extra Cash; and 3) Be Consistent.

Make small sacrifices where you can, but remember to celebrate your victories. Don’t look at your debt as a punishment--this will only keep you mentally bogged down. When you are in debt-repayment mode, how you got into debt in the first place is an important factor to consider (you don’t want to get into debt again), but it is not the only part of the process you should focus on. The other part is to reward yourself for the progress you are making. You don’t need to go back into debt to celebrate reaching a goal, obviously, but something simpler like a nice dinner out or doing a fun activity like going to a concert can be a way for you to celebrate the progress you are making toward your debt repayment goals.

References

- Harkness, Brendan. How to Pay Off Debt: 6 Strategies That Work. (2019, August 28). Retrieved from https://www.creditcardinsider.com/learn/reducing-debt/ (accessed 2019, September 17).

- NerdWallet. Pay Off Debt: Tools and Tips. (2019). Retrieved from https://www.nerdwallet.com/blog/pay-off-debt/ (accessed 2019, September 17).

- Ramsey, Dave. How to Pay Off Debt. (2019). Retrieved from https://www.daveramsey.com/blog/how-to-pay-off-debt (accessed 2019, September 17).

- Steinberg, Stephanie and Sneider, Susannah. 10 Easy Ways to Pay Off Debt. (2019, June 13) Retrieved from https://money.usnews.com/money/personal-finance/debt/articles/easy-ways-to-pay-off-debt (accessed 2019, September 17).